Balance Transfer

Transfer Your Balances to an Excite Credit Union Credit Card

Save money and transfer your balances from higher interest rate credit cards.

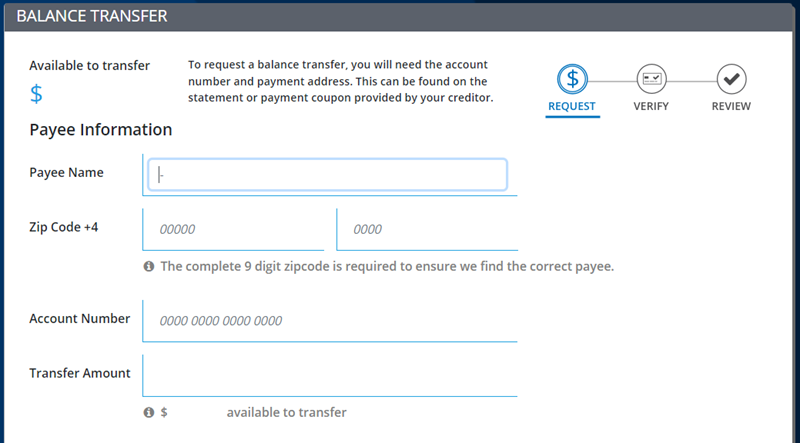

What You'll Need For Your Balance Transfer:

- Name and payment address of the other creditor or financial institution (Excite Credit Union Accounts are excuded)

- Your account number at that financial institution

- The amount to transfer

Steps to take to do a Balance Transfer

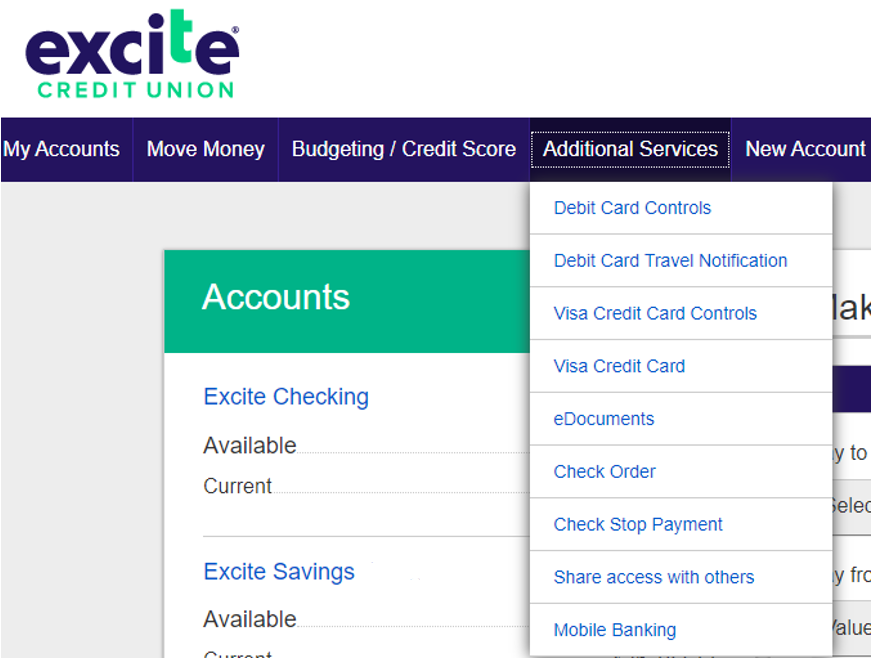

1. Login to Online Banking and go to Additional Services/Visa Credit Card:

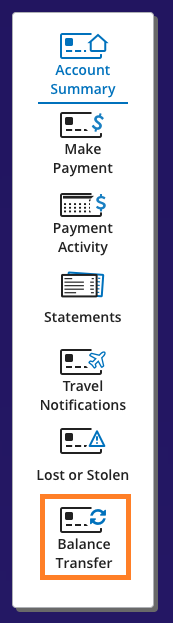

2. Select Balance Transfer from Menu

3. Enter Balance Transfer Information and click Next, add additional transfers or submit to process

If the payee is a large merchant or financial institution, they may be set up on ACH payment. ACH payments will transfer within 3-5 Business Days. If a check must be mailed, payment issuance can take 7-10 business days. Please allow an additional 7-10 business days for mailing.

Questions About Balance Transfers?

A balance transfer is when you move the balance of one or multiple credit cards or other loans to a new or existing credit card account. It’s a smart way to save money on interest, consolidate payments and pay off credit card debt sooner.

If you’re looking to save on interest, lower your monthly payments, or consolidate payments, it’s worth looking into a balance transfer. This may be a helpful move, allowing you to pay off debt more quickly and take control of your finances.

That depends on a few factors. Applying for a new credit card will result in a hard inquiry on your credit report, which can lower your score temporarily. Adding a new card will affect your overall length of credit history, which could also temporarily lower your score. On the other side, a new card with a new line of credit can reduce your overall credit utilization, positively impacting your score.

Yes, but you should join us. We’re different from the other banks and credit unions because we're here to help.

You can easily apply online or stop by one of our locations to join in person.

Refer to your Credit Card Opening Disclosure details regarding rates, terms, and fees associated with a balance transfer. If an introductory rate is in effect when the introductory period expires, your non-discounted APR will change to a regular rate as disclosed on your Credit Card Opening Disclosure. We will begin charging interest on balance transfers on the billing statement cycle date. The minimum payment will be applied to lowest rate balances first while all payments exceeding the minimum payment due each billing period will be applied to balances with high APRs prior to balances with low APRs. Current Excite credit card balances are not eligible for balance transfers. Reward points are not awarded for transferred balances. Impact on your credit may vary, and some users’ scores may not improve as credit scores are independently determined by credit bureaus based on a number of factors. Excite Credit Union will report your transactions to Transunion®, Experian®, and Equifax®. Speak with an Excite representative for details.

★★★★★

I love this Credit Union!!! Best rates, highest payouts for deposits. Nice folks too. I am shifting the entirety of my indebtedness to them because the rates are so good, and I was tired of getting hit with huge interest at the end of every month. 5 stars.

~ Braxton W.